WH official warns of 'catastrophic' economic circumstances if admin loses tariff case at Supreme Court

Associate White House counsel Graziella Pastor relays the urgency of the looming Supreme Court decision on President Donald Trump's authority to impose tariffs under a state of emergency.

FIRST ON FOX: Texas Rep. Nathaniel Moran is turning tariffs into a debt-cutting tool, unveiling legislation that would funnel billions in new trade revenues into a trust fund aimed solely at shrinking America’s staggering $37 trillion national debt.

The Tariff Revenue Used to Secure Tomorrow (TRUST) Act would establish a special account at the Treasury Department called the Tariff Trust Fund. Starting in fiscal year 2026, any tariff money collected above the 2025 baseline level would automatically go into this fund. By law, that money could only be spent in one way: to shrink the federal deficit whenever the government is running in the red.

"President Trump’s bold use of tariffs has already proven effective in bringing foreign nations back to the negotiating table and securing better trade deals for America. That short-term success has produced record-high revenues, and now we need to make sure Washington doesn’t squander them," Moran told Fox News Digital.

TRUMP SAYS US WOULD BE 'DESTROYED' WITHOUT TARIFF REVENUE

"The TRUST Act ensures those dollars go where they are needed most—toward reducing our national debt and protecting the financial future of our nation."

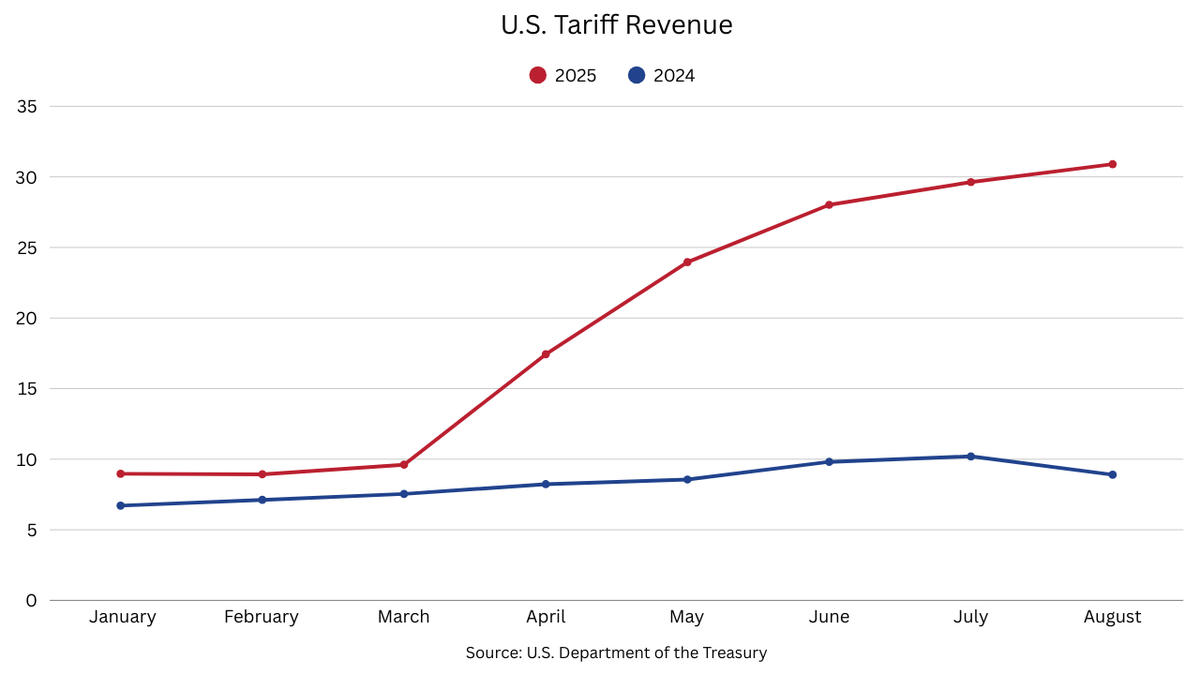

Moran's legislation comes after the U.S. collected more than $31 billion in tariff revenues in August, the highest monthly total so far for 2025. Total tariff revenue for 2025 has reached more than $183.6 billion, according to the "Customs and Certain Excise Taxes" data released on Aug. 29 by the Treasury Department.

Tariff revenues rose steadily from $17.4 billion in April to $23.9 billion in May, before climbing to $28 billion in June and reaching $29 billion in July. At the current pace, the U.S. could collect as much tariff revenue in just four months to five months as it did during the entire previous year. At this point in fiscal year 2024, tariff revenues were at $86.5 billion.

Rep. Nathaniel Moran, R-Texas, walks down the House steps after the final votes in the Capitol before Congress' October recess on Wednesday, Sept. 25, 2024. (Bill Clark/CQ-Roll Call/Getty Images)

TRUMP CALLS TARIFF WINDFALL 'SO BEAUTIFUL TO SEE' AS CASH SAILS IN

The surge in revenue coincides with a federal appeals court ruling that President Donald Trump overstepped his authority by using emergency powers to impose sweeping global tariffs.

In its Aug. 29 decision, the court said the power to set such tariffs rests squarely with Congress or within existing trade policy frameworks. The ruling does not affect tariffs imposed by other legal authorities, such as Trump’s levies on steel and aluminum imports.

Attorney General Pam Bondi announced the Justice Department will appeal the decision to the Supreme Court. In the meantime, the court allowed the tariffs to remain in place through Oct. 14.

A year-over-year comparison of tariff collections. (U.S. Treasury)

Treasury Secretary Scott Bessent previously said that the Trump administration could apply part of the tariff revenue toward lowering the national debt.

The nation's debt, which is the amount of money the U.S. owes its creditors, is nearing $37.4 trillion as of Sept. 3, according to the Treasury Department.

The staggering figure has intensified the long-standing debate in Washington over government spending, taxation and efforts to rein in the ballooning deficit.

Treasury Secretary Scott Bessent during a House Ways and Means Committee hearing in Washington, D.C., on June 11, 2025. (Eric Lee/Bloomberg/Getty Images)

CLICK HERE TO GET THE FOX NEWS APP

"Complacency is no longer an option. We must act with urgency and begin to bring down our national debt immediately," Moran added in a statement.

Bessent has also previously said that tariffs could generate more than $500 billion in revenue for the federal government. U.S. businesses pay these import taxes to the federal government, but the cost often falls on consumers, as companies raise prices to offset the economic burden.