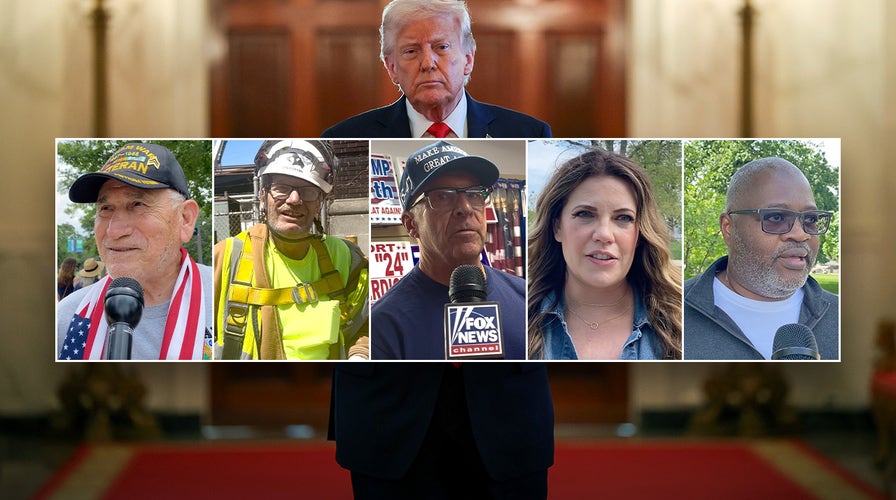

FIRST 100 DAYS: Here’s what Americans want President Trump to focus on next

People in Tennessee, Texas, Washington D.C. and Michigan deliberate the Trump Administration's first 100 days in office.

President Donald Trump campaigned for a second term on pledges to lower prices, create jobs and impose tough tariffs on imports, especially from China.

Dubbing himself the "Tariff Man" last fall, he told an audience at the Economic Club of Chicago, "To me, the most beautiful word in the dictionary is tariff." However, in his first months in office, it is unclear whether Trump can, or should, implement the harsh reciprocal tariffs he announced in April against dozens of countries.

Now, 100 days into his second term, economists told Fox News Digital they see these proposed reciprocal tariffs as politically motivated, unnecessary and failing to secure the benefits from U.S. trading partners that Trump had been hoping for.

CHINA IS ‘CAVING’ TO TRUMP'S TRADE WAR STRATEGY, EXPERT SIGNALS

President Donald Trump holds a "Foreign Trade Barriers" document as he delivers remarks on tariffs in the Rose Garden at the White House in Washington, D.C., on April 2, 2025. (REUTERS/Carlos Barria/File Photo)

Instead, they warned, Trump's tariffs could grind billions of dollars in trade to a halt between the world's two largest economies, disrupt global supply chains and risk torpedoing the U.S. economy into a major slump or recession.

When Trump took office, chances of recession "were probably about 10%," Justin Wolfers, an economist at the University of Michigan, told Fox News Digital in an interview. "Now, they’re up to around 55%."

It is unclear whether Trump will continue to push through with these unpopular tariffs, which are slated to take force in early July. In the near-term, uncertainty and volatility remain.

Traders work on the floor of the New York Stock Exchange in New York City on March 28, 2025 amid President Donald Trump's escalating trade war. (Spencer Platt/Getty Images)

Short-term tariff impact

Trump announced tariffs on April 2, dubbed "Liberation Day." The announcement included both a 10% universal baseline tariff and plans to enact larger tariffs on dozens of other countries, including China.

These new import taxes immediately sent stock markets into free-fall, triggering one of the largest single-day S&P 500 losses since World War II, and prompting deep and unyielding uncertainty over possible next moves.

"The only thing that's happened that has pushed the odds of a recession up so high, so fast, is chaos coming from out of the White House," Wolfers said.

Trump subsequently paused the reciprocal tariffs for 90 days to encourage the administration to make "deals" with countries on trade and encourage more investment in U.S. manufacturing. Even so, some prices have already risen in anticipation of higher costs under the new tariff regime.

Uncertainty has also played a role. Trump's tariff announcement in April prompted a number of large container ships to abruptly halt their shipments to the U.S. earlier this month and turn back to their original ports. This means that more consumers will see a price hike for everyday products, likely at certain big-box retailer stores like Walmart or Target, as early as next month.

These price hikes are "not showing up tomorrow, but will show up over the next few months, as scarcities develop and American retailers have to find other sources – that might take a while," David H. Feldman, an economist and professor at William & Mary, said in an interview.

President Donald Trump arrives for a presentation ceremony in the East Room of the White House on April 15, 2025, in Washington, D.C. (Win McNamee/Getty Images)

While Trump says tariffs will target foreign competitors and reduce the trade deficit, the costs will fall mostly on working- and middle-class Americans who buy the bulk of imported goods.

Wolfers said Trump's focus on the trade "deficit" is based on a common misconception.

"What that means is we sell China a small amount of stuff, and they sell us a large amount of stuff," he explained. However, for every dollar bill that goes to China, the U.S. gets something for it that Americans want to buy, like T-shirts.

"We have a dollar deficit – but we have a stuff surplus."

Potential for deescalation

There are few signs that Trump's tariffs will deliver the gains he sought, such as onshoring U.S. production or securing better trade deals, particularly with Asian countries.

Instead, experts warn these countries are likely to circumvent U.S. markets and supply chains over time.

"If these tariffs stay in place, there will be hardly any trade between the U.S. and China," by the second half of the year, Gary Clyde Hufbauer, a senior non-resident fellow at the Peterson Institute for International Economics, said in an interview.

Roughly $650 billion in annual trade between the two countries is at risk, along with knock-down effects on global commerce in the long term.

WORLD LEADERS REACT AS TRUMP RE-ENTERS THE WHITE HOUSE

President Donald Trump and Chinese leader Xi Jinping

Trump's tariffs also discard decades of international understanding that has depoliticized trade disputes, Feldman said.

The U.S. is "moving from a system that at least was based on mutually acceptable rules of behavior to a system that does not have that as its anchor," Feldman, whose research focuses on global trade policy, told Fox News Digital. That shift allows the government to target foreign nations individually and offer selective tariff relief to firms and industries "if they do ‘our’ bidding," he argued.

"America is now master of the shakedown."

President Donald Trump gestures to members of the media before boarding Marine One on the South Lawn of the White House on April 3, 2025. Trump spoke a day after announcing sweeping new tariffs targeting goods imported into the U.S. on countries including China, Japan and India. (Andrew Harnik/Getty Images)

Next steps

After market backlash, Trump appears to be warming to the idea of easing his proposed 145% reciprocal tariffs on China, which has vowed to impose its own retaliatory measures on U.S. goods.

Economists say he is more likely to do so if the economy sours, or he sees a major drop in poll numbers, if the past is precedent.

Still, any path to deescalation remains uncertain. Just last week, China denied Trump's claim that the two countries were negotiating a tariff deal, after he asserted in an interview that he had reached "200 deals" on trade.

Economists believe Trump will at least partially scale back the tariffs before July but warn he is playing a high-stakes game of brinkmanship that could hit U.S. consumers and businesses hardest.

"What I worry about is that the immediate impact of uncertainty is on business investment in trade-exposed industries, leading to a recession," Feldman said. "But it could get worse, if it transmits into a financial panic. And if everyone starts to say, 'geez, I got to get into gold and cash, I can't be in Treasury bills.' If we move into a flight to cash, all bets are off."

Should that happen, he said, "We could slide into 2008 all over again."

A television broadcasts market news on the floor of the New York Stock Exchange in New York on April 4, 2025. (Michael Nagle/Bloomberg via Getty Images)

Trump has refused to concede that his early days have been anything but a major success.

In a recent interview with Time magazine, he touted his first 100 days as "very successful," saying "people [are] writing that it was the best first month, and best second month, and really the best third month" for a U.S. president.

He dismissed stock market volatility and rising inflation as temporary "market fluctuation," calling it a "transition period" that would level out.

When asked if he would consider it a win if tariffs remained as high as 50% on imports a year from now, Trump said he would.

CLICK HERE TO GET THE FOX NEWS APP

"Total victory," he said.

"Everybody is going to benefit."